- RollUpEurope

- Posts

- How 30+ software aggregators live and breathe. Insights from our 2nd Software Serial Acquirer Summit

How 30+ software aggregators live and breathe. Insights from our 2nd Software Serial Acquirer Summit

Is the ARR multiple dead? And what comes next in the AI Era

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

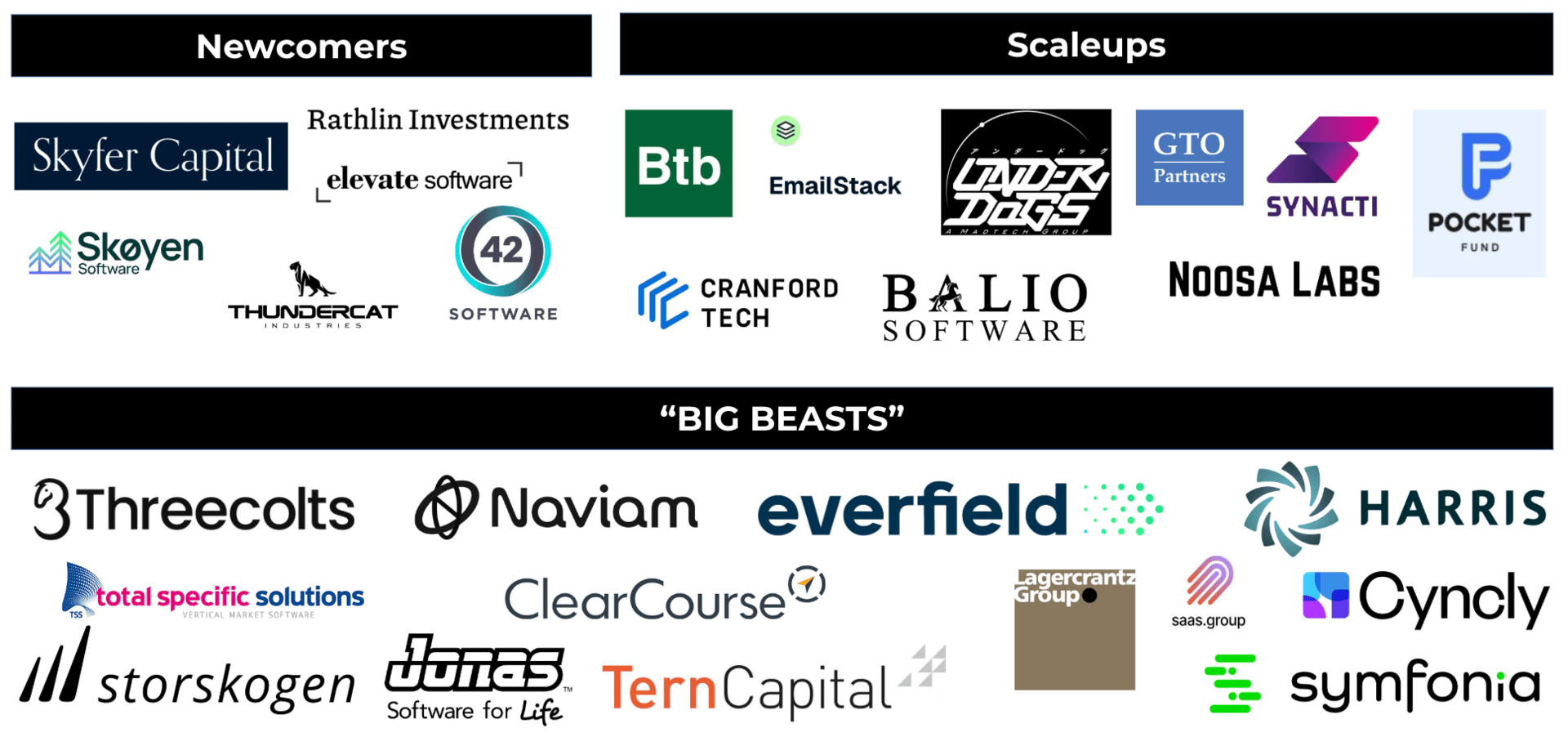

On 6 May in London, we gathered 130 founders, operators and investors. This included 30+ tech serial acquirers ranging from fledgling aggregators like Skyfer or Skoyen (both established in the past 12 months!) all the way to 9-figure revenue corporate beasts like Cyncly, Symfonia and Jonas:

If you want to network with software serial acquirers, there is no place like RollUpEurope events.

Over a couple of hours, we covered a lot of ground:

How to source deals on social media in 2025

Software investing in the AI Era

Value creation in software M&A

De-risking deals through commercial due diligence

Before we tuck in, I want to acknowledge the tremendous support from our sponsors SourceScrub and PPH Financial. See how SourceScrub supported a UK VMS newcomer, Synacti:

Dev Shah, the founder of the micro SaaS investor-cum-sourcer Pocket Fund (and the subject of last week’s article) kicked off the event by pointing out a major drawback in the software acquirers’ sourcing strategies.

Namely, everyone’s fixated on three channels - which no longer convert:

LinkedIn

Cold emails (Apollo etc.)

Generic corporate blogs / newsletters - compiled by ghostwriters with the help of AI

In Dev’s experience, 90%+ of founders of $100K to $2M ARR businesses:

Are not active on LinkedIn and/or

Are hesitant to engage with brokers / marketplaces and/or

Are swamped by generic cold outreach from potential buyers

They are, however, very active on other social networks. Like X, Facebook, Instagram and Reddit.

Dev repurposed a famous meme to illustrate the point:

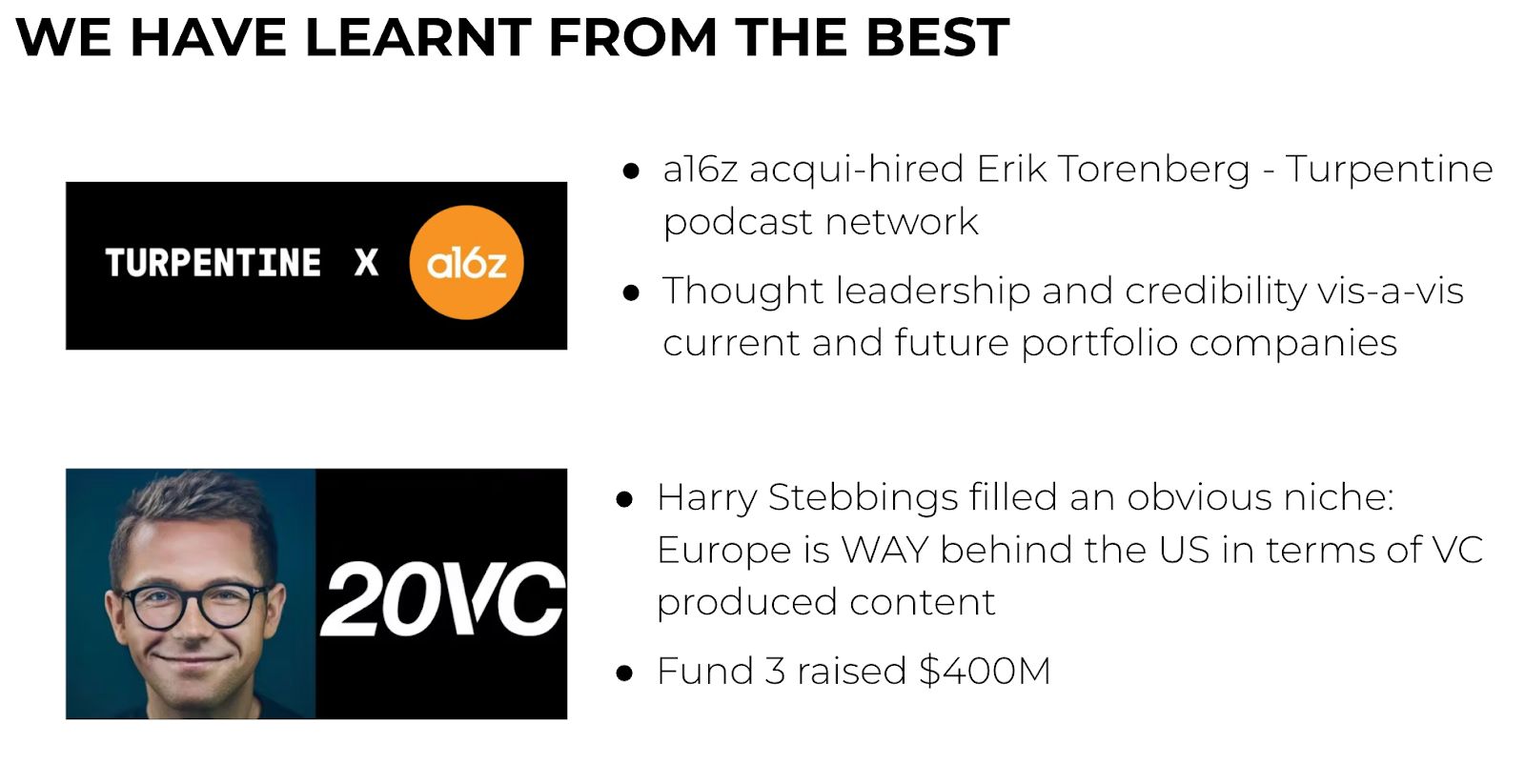

Dev’s approach is not exactly groundbreaking. He is merely repurposing the playbooks of a16z and 20VC for the micro SaaS space:

Dev’s team spends their days sifting through endless discussion groups, like https://www.reddit.com/r/sidehustle/. Given the manpower requirement, this approach works in countries with abundant, cost competitive workforce. Like India (Dev is based in Mumbai). Often, Dev’s team will film themselves breaking down a SaaS or newsletter they like, and share the video with the founder.

My takeaway: if you are capable of producing engaging content in a highly consistent manner, you don't need Dev - or external sourcers for that matter. Having said, how many software aggregators can successfully say they do?

2. Software investing in the AI Era

In this session moderated by Aries Shomalistos, Partner at RPL, a commercial DD / strategy advisor, we heard from:

Rich Bolton, Investor at Octopus (VC firm)

Felix Perner, Investment Professional at GRO (PE firm)

Marius Huber, founder at Btb Web Ag (serial acquirer)

First question: where on the AI adoption curve are the investment professionals themselves?

According to Felix, at GRO “there is no corporate agenda yet - every professional has his tool kit”. Having said that, he is seeing an uplift in cold outreach conversion, from the typical 20-30%. Response rates meaningfully increase when the initial comms are enriched with the details on the founders.

Turning to the portfolio companies:

Felix: GRO backs larger, more mature businesses (20M+ ARR). Therefore they focus on the defensive aspect. Is there an AI startup coming out of nowhere that could jeopardise the incumbent’s business model?

Marius: for Btb, the AI piece is mostly about value creation. Does an app create value at all? Let’s take private banking. High value investment decisions are always made in person. Whereas the onboarding piece (KYC etc.) of course can be digitised. As for tangible example from Btb’s portfolio, Marius described an AI agent that plugs into Gmail and drafts replies to customer queries. CSM productivity skyrockets. Frankly, Marius rubbished the notion of “AI first” companies. The viability of a business depends on its value proposition - which AI enhances. “AI agents are LLMs with webhooks. Their viability depends on the tradeoff between explaining something to software vs. to a human”

Rich: “We don't like AI businesses but rather businesses that use AI to improve other businesses. This resonates well with corporate clients”

What metrics should software investors be using in the AI Era?

The ARR is dead…sort of. Rich acknowledged that traditional SaaS metrics like ARR are prone to manipulation (the 11x saga etc.). Growth rate still is their No.1 metric as it represents future potential. Acquire a larger equity stake to mitigate downside

Next level down, Octopus would audit the tools being used by the portfolio company’s tech team. “Looking at AI tool usage, how many features are you shipping through Cursor?”

Finally, what does customer interaction look like? (FWIW, this sounds like nothing’s changed for serious investors - it’s the punters doing NO diligence on the customer base that risk being caught out when the tide goes out!)

This last bit all 3 speakers agreed on. In the AI Era, Commercial DD has become MUCH more important. Tech and financial DD are less important

Felix sees PE and VC valuation frameworks converging. Everyone is focused on IRR / MOIC

Managed services = unsexy but build stickiness. If you are only selling a product, and not a holistic solution, you’re much more likely to be replaced

Marius: agents = LLM with a webhook. It boils down to, how easy is it to explain something to software vs. a human?

Felix: 3 main dimensions. Chips, data centers and algorithms. All three are growing 3X per year. We are still very much on the way up! David Sachs

Final thought: there’s a notable uptick in interest in Managed Service Providers. “Unsexy but sticky businesses” much less likely to be substituted than mere solution (pure SaaS) providers

3. Value creation in software M&A

Andy Lister, the UK CEO of Lagercrantz (a prominent Swedish serial acquirer) was joined by:

Thomas Llewelyn-Lloyd, a Principal of Tern Capital (serial acquirer)

Joao Boto Goncalves, Head of Transformation & Integration at Cyncly (PE backed buy and build)

Wernher Pikali, Strategic Business Partner at Everfield (PE backed HoldCo)

First things first: what do all these companies do?

Lagercrantz owns 85 businesses and acquires 8-10 each year. What kind of businesses? Traditional - but niche ones. Think “manufacturer of acoustic activated doorstops”

Cyncly is a buy and build that focuses on “software solutions for designing, selling, managing, and making customizable products and spaces”. In plain English, their software powers industrial kitchen cabinet makers, like IKEA. Went from $70M to $300M in 3 years

Tern is a deal-by-deal acquirer of UK VMS. Currently invested in 6 businesses with £1-5M revenue range

Everfield is one of Europe’s most prolific VMS HoldCos. 30 acquisitions in 3 years across Europe. Vertically agnostic - focus on driving organic growth. For our deep dive on Everfield’s structure, including equity incentive pool, read here

Key value drivers in any software deal (in descending order of ease of execution):

Raising prices

Enabling outbound sales motion

Insourcing payments

Improve capability to generate information by upgrading financial and reporting systems

Moving from perpetual licence to subscription model

Andy kicked off the panel by noting that most businesses that he sees raise prices by 2-3% p.a. In his opinion, this is far too little. Companies that offer differentiated products can raise prices by 5-10%. Thomas: “many software businesses have not raised prices for 5 or even 10 years”. Wernher: “many companies have no outbound sales motion at all”.

Don't get carried away though! For Tern, in some cases the base case is zero price increase for 10 years.

Wernher from Everfield talked about his experience with businesses that have “many products but are not selling enough on top of existing products”. The low hanging fruit is marketing channel analysis: not just LinkedIn! Robust CAC data is key to determining how much to spend on each channel.

With 30 acquisitions in the bag, Everfield’s value creation playbook is highly sophisticated:

First, Wernher’s team carefully maps out strategic levers to drive value well ahead of closing. They always sit down with the management team to compare notes: what is possible?

After closing, it is crucial to have a thorough onboarding phase. This helps align expectations between management and the new owners. Everyone is looking at the same type of KPIs. After 3 months the hand holding stops.

For Cyncly, which unlike Everfield is centralised and integrates everything, the post merger integration phase lasts longer. Weekly progress updates for the first 6 months.

Tern integrates the back end where there are cost synergies. Finance, legal and HR. Definitely not tech. Within Customer Success, they seek to “cross pollinate” by sharing best practices.

Lagercrantz is similar to Everfield in terms of operating under a decentralised model. Even more so: “the only thing that the portfolio companies report are their financials on the 9th of every month”

4. De-risking deals through commercial due diligence

We rounded off the Summit’s formal part with a panel moderated by Lewis Singleton, the M&A Integration Lead at Dwelly (a rollup of UK estate agents). Lewis’ interlocutors included:

Pavel Prokofiev, Head of M&A at saas.group (serial acquirer)

Jose Vidal de Sousa, Director at GTO Partners (PE firm)

Elliot Vickerstaff, Investment Manager at Pelican Partners (a family office backed software and tech services investor)

Unsurprisingly, all three panelists emphasised efficiency:

Elliot / Pelican: accelerated value creation period in context of a 2-3 year hold. In commercial DD, focus on “what’s going to keep them up at night” Do a lot of customer and competitor referencing to contextualise and validate key themes

Jose / GTO: prefer software and IT services firms that cater to mid-sized customers. Firms with defensible business models and double-digit organic growth rates (who doesn't like those!). GTO’s approach to CDD:

Start work in house and do as much of the work as possible prior to involving external advisors. Get early questions and buy in from the IC. From the outset, rule out reasons not to do the deal

Pavel / saas group: as a sector and vertical agnostic aggregator, do not have the luxury of time like PE firms that can spend a year honing a thesis in preparation for a sell-side.

saas.group is good at spotting patterns, like businesses “that have no customer support tickets because the product is so good”. As Pavel elaborated, many bootstrapped founders dislike talking to customers so much they create products that do not require them to.

Don't think about CDD as a check-box exercise. In Tax or Legal DD, there is no upside. In CDD, the upside can be huge. Had an owner who had sold a lot of subscriptions at a loss. Luckily the customers were not price sensitive, and saas.group were able to raise prices substantially. Grew MRR 20% in a single month!

Don't get stuck debating the wrong questions! To quote Pavel, “don’t let people debate whether Company ABC is the right business”, without referencing specific criteria. Have processes in place and avoid shifting goalposts.

Why, and how to choose an external CDD provider?

The panelists offered several reasons:

One, a voice of customer report done by a third party provider can help reduce purchase price. “Our expert said that 2 of top 3 customers are likely to churn” - who can argue with that evidence?

Two, it saves previous time. Good consultants know what questions to ask

Three, as Jose said “raising prices and driving cross-sell is easy on a spreadsheet”. GTO will work with an industry expert to validate hypotheses

Four, lenders often require third party validation

At the end of the day, you get what you give. The tighter the DD scope, the more likely you will receive a crisp 10-20 page reports, as opposed to a meandering one that’s 50 pages long.

Summary

Our 2nd Software Serial Acquirer Summit in London gathered 130+ founders, operators, and investors - including 30+ tech serial acquirers ranging from newcomers to established firms with 9-figure revenues.

Traditional deal sourcing channels (LinkedIn, cold emails) are increasingly ineffective for reaching founders of sub $2M ARR businesses. Dev Shah pointed out they are far more responsive on platforms like X, Facebook, Instagram, and Reddit.

In the AI era, investors prioritize businesses that use AI to enhance existing value propositions rather than "AI-first" companies. Commercial due diligence has become more important than technical and financial DD.

Key value creation drivers in software M&A include raising prices (many founders underprice by 5-10%), enabling outbound sales, insourcing payments, and upgrading financial systems.

Successful acquirers employ different integration approaches - from light-touch decentralized models to complete back-end integration - while effective commercial due diligence should identify value creation opportunities rather than functioning as a mere checkbox exercise.