- RollUpEurope

- Posts

- The Rollup of Tomorrow - Vol 2. Rebel Capital: a peek inside an "AI first" SaaS HoldCo

The Rollup of Tomorrow - Vol 2. Rebel Capital: a peek inside an "AI first" SaaS HoldCo

Two first-time acquirers buy, then turbocharge a 17-year old SaaS business. Here's how they did it - and what comes next.

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

Everyone’s talking about “HoldCos that install AI”. How about a real life example - in software?

Episode 2 of our “Rollup of Tomorrow” series features Vadim Rogovskiy, a tech entrepreneur originally from Ukraine now based on the West Coast. A few months ago, Vadim and his business partner Hanna Markouskaya launched a software HoldCo called Rebel Capital. Rebel has several USPs, such as EVE - its in-house AI co-pilot, which has been road tested on Leadature, an event management software and Rebel’s acquisition #1.

In the interview, Vadim talked about:

His journey from a tech founder to an acquisition entepreneur (via a stint in VC)

Building the deal pipeline of scratch, and the importance of proprietary deal flow

Structuring his first acquisition to maximise the SBA borrowing opportunity and to align incentives between the owner and the acquirer

The low hanging fruit in mature SaaS companies - and how to harvest it

Rebel Capital’s plan for growing revenue from $2M to $100M

The Rollup of Tomorrow series is sponsored by Sourcescrub: the No.1 deal sourcing tool for serial acquirers.

If you'd rather listen to the audio version, check out our Rollup Stories podcast on Spotify!

Alex: Vadim, you are a serial tech entrepreneur with several exits under your belt. Tell us more about yourself and how you discovered Entrepreneurship Through Acquisition (ETA)?

Vadim: I've been running startups for the last 16 years, straight out of university. I have had different outcomes, including one exit; one business going strong; and one that shut down. I was also a VC for 3 years. It was a great experience, but at some point I realised I didn't like the “spray and pray” model in which you don't really create a lot of value. I'm the operator type.

I was looking for investment opportunities where I could unlock value by implementing AI, improving Go To Market etc. I was not getting that in the VC model. I kept looking around, and that’s how I stumbled upon ETA.

Alex: Your story resonates a lot! Our networking events teem with exited founders who had a go at the VC game but didn't like it because of the perceived low value-add and the low probability of success.

Candidly, I'm surprised you didn't discover the ETA sooner.

Now, let's talk about your first acquisition, the event management SaaS Leadature. What does this business do exactly? How much did you pay? How did you finance the acquisition?

Leadature’s product is a hit within the event management industry

Vadim: We started from scratch. As part of our research, we met a lot of people doing this on a deal-by-deal basis [Independent Sponsors]. For me, this felt like a nightmare option as there are too many moving pieces. You need to find a target. You need to find the investors. And you are hoping the target won't go away in the meantime. Seeing the vast majority of these deals fall apart and drain the sponsors’ energy, I decided that we should at least solve the funding part.

We took on SBA financing. SBA loans are handy: you can borrow up to $5M per deal, with interest capped at base rate plus 3% for larger deals. For deals up to $150,000 you can get an 85% LTV and above $150,000, 75% LTV (source).

With the funding piece sorted, our attention turned to the deal flow. As we wanted to buy a software company, we connected with all the top brokers and the marketplaces. The results were disappointing. For sure, all brokered deals were beautifully wrapped. You know, these “great” businesses where the owner spends 1 hour per week and it is producing a 30% SDE margin. In 99% of all cases this beautiful picture simply isn't true. For example, the entire team is “missing” from the payroll.

For me, investing in proprietary outreach was intuitive given my prior experience and the fact that I was able to bring over some of my former colleagues. We built a database of targets, started sending personalised emails and LinkedIn messages. Conversion rates were up to 10% [from cold email to initial call]. Many of those calls were a waste of time of course, since people were just curious or wanted to raise money, not necessarily to sell. Still, we have managed to speak to 100+ companies. I highly recommend investing in proprietary deal sourcing.

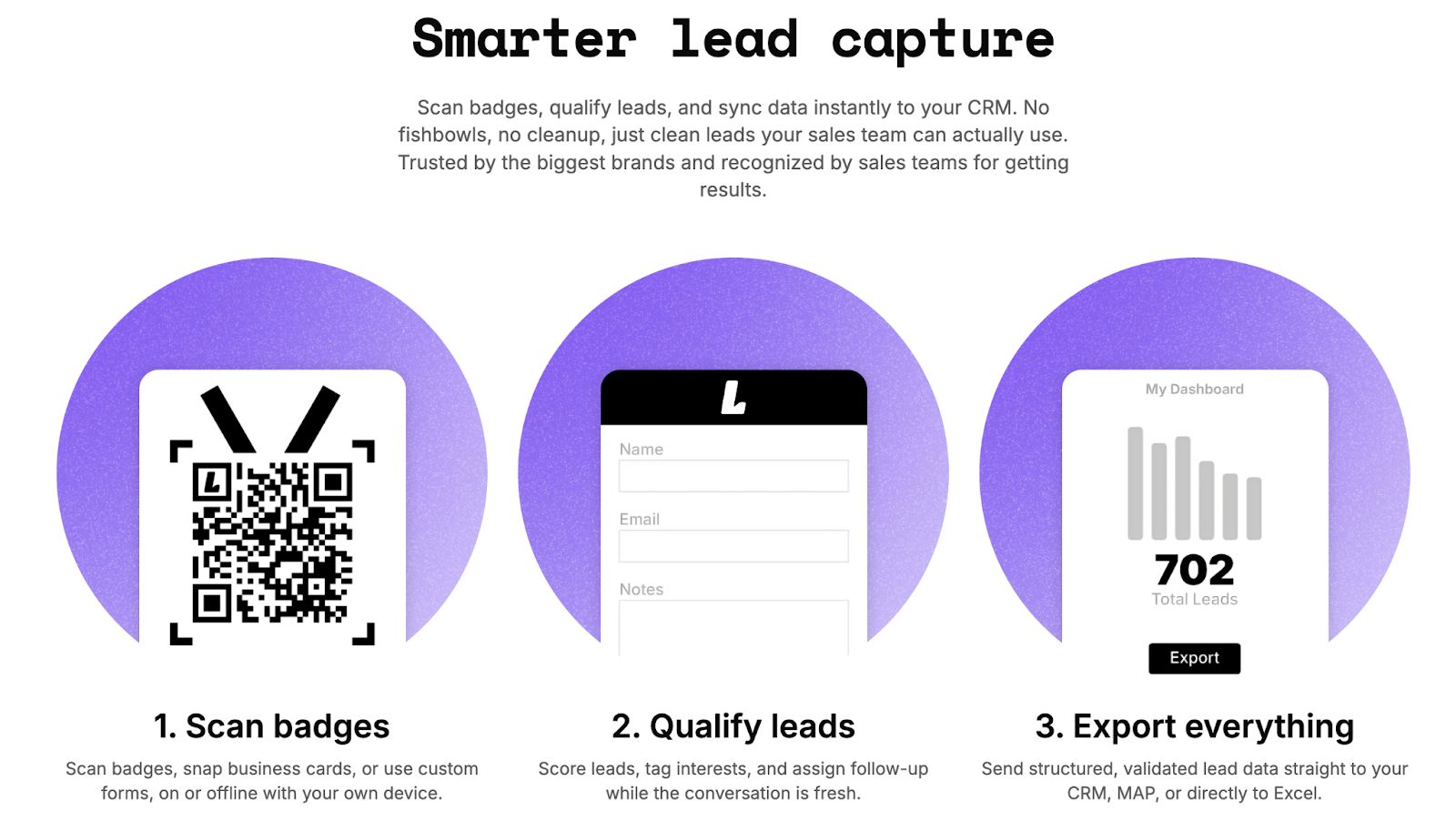

We ended up acquiring Leadature - a Las Vegas based software business that offers lead capture solutions for exhibitions, tradeshows and conferences. Leadature came with $2M revenue and a high EBITDA margin.

Moving onto the deal structuring. 50-60% of the purchase price was funded by the SBA loan and 40%+ by the Seller Note connected to performance goals. The main goal was trailing 12 month revenue for a period of 2 years after deal closing.

Alex: At this point, you have built a solid outreach sequence. You have found a great business. You have lined up the financing. And from the sounds of it, you put in place a good incentive structure to ensure that the business continues to perform.

Now, here’s the kicker.

The fascinating thing about the Leadature deal is that it set in motion a whole new business. I checked your LinkedIn profile before the interview, and it says cryptically that you've been building “an AI powered co-pilot that will take over at least 80% of the business owners’ repetitive tasks and workflows”. I am very intrigued because everyone's talking about AI in rollups. What is this about?

Vadim: Many of the businesses that we spoke to were marred by inefficiencies that can be solved with AI. Especially small teams that run on email. They answer all customer questions and complaints through email. They submit RFPs through email. They pay invoices through email. Lots of repetitive tasks that require people digging into email history. With the agentic AI revolution happening in the background I thought, maybe we should have the AI tool ready before buying the company.

Dean, the founder of Leadature, had had the same email since 2008. Everything was there. And even though Leadature was using a niche CRM system, there was a massive wedge between the contents of the CRM and the emails history. It gets better. Even though the owner was very tech savvy, he didn't use workflow software like Jira or Trello to communicate with the developers. It was all on email!

So we close the deal, and the owner hands over the credentials to his email. I couldn't wait to dig into Dean’s email, confident there must be an off-the-shelf AI solution that can go into your email and analyse huge amounts of data. A solution that would give you a dashboard of things you should go after.

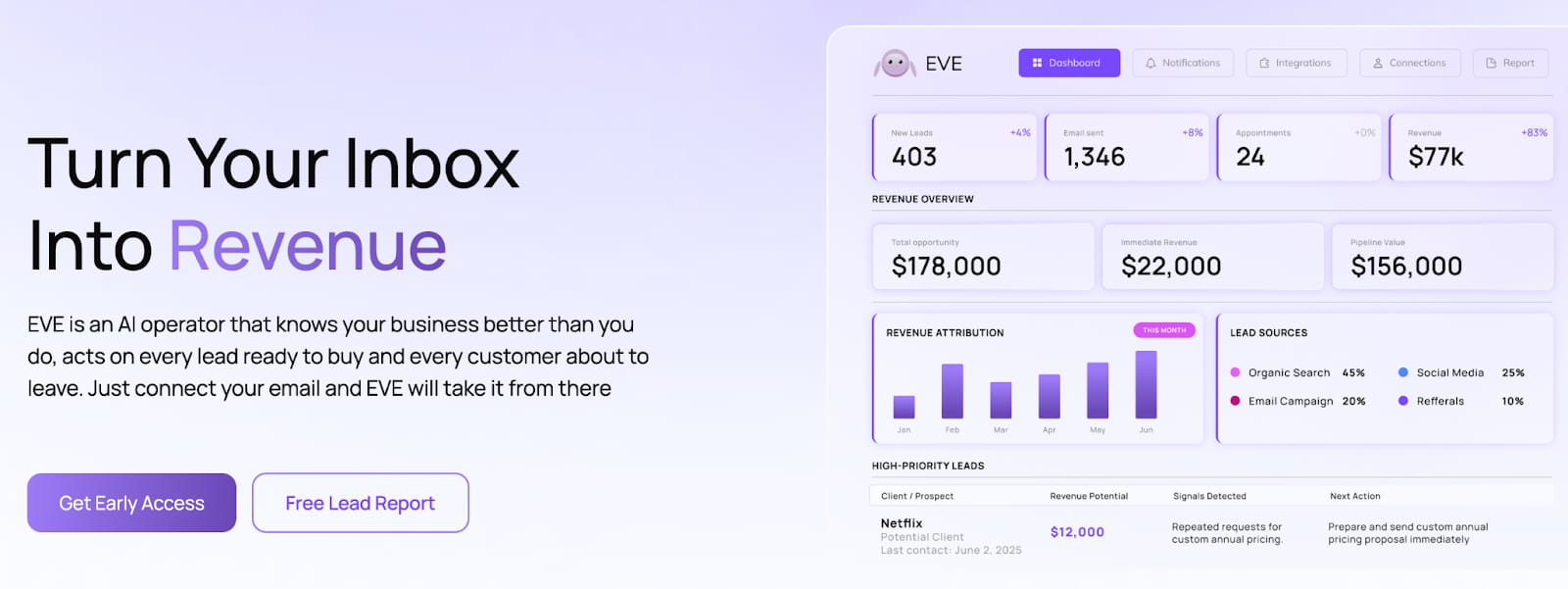

Oops! Turns out there was no such solution. So we decided to build a Minimum Viable Product ourselves. We created a solution that connects to your email - either Gmail or Microsoft via SSO - the way you connect to any other service.

That’s how EVE was born.

Once connected, you run a very specific search, a multi-prompt search, looking for signals related to revenue. EVE gives you a list of missed leads. In Leadature’s case, there were lots of missed leads because, well, things tend to slip through the cracks in a small team used to multi-tasking. We fed this list of leads into EVE, which then drafted, and sent out emails with deep business context. The EVE AI agent can cover 80% of what the Leadature team does on a day-to-day basis, since their work revolves around answering questions. Sending proposals, scheduling demos, that sort of thing.

Alex: Awesome. What is the longer term vision for Rebel Capital and for the AI business? Do you plan on building a software HoldCo - or to become a vendor to other HoldCos, helping them improve businesses after acquisition?

Vadim: The HoldCo goal is $100M in revenue by 2030. We have had many conversations about the strategy. Should we immediately pursue a roll-up strategy - or stay agnostic, Enduring Ventures style? We opted for the latter, but staying within software. We're looking for verticals that are fragmented, where VC capital is really scarce and where there are a lot of small players that all sell to the same customers. Event management is a great example. Also retail technology - any companies that help offline and online retailers sell more. The main thing is unlocking huge productivity gains with AI to increase EBITDA margin consistently.

Alex: You are riding two major trends of 2025: 1) acquiring software businesses and improving them; and 2) building the tools to enable those serial acquirers. For people reading this article, what do you need from them - and what can you offer them?

Vadim: We are keen to speak to investors first and foremost, to people who understand the advantages of the permanent equity model and the incredible returns that it can bring. On the EVE side, we are offering a free pilot, both to business leaders who want to extract leads and opportunities sitting in their emails and to the acquirers who have just bought a business and want to understand what’s really inside. And I'm not only talking about sales. An acquirer I recently spoke to is keen to leverage EVE to understand whether the SPA reps and warranties were followed, and disclosure was complete. In July, we are running the pilot absolutely free of charge!

Alex: Sounds like if you're in the business of buying companies and you want to leverage AI, it's Vadim you have to talk to. Thank you very much for sharing your journey Vadim, and I hope you get some business from this interview.

Vadim: Thank you!