- RollUpEurope

- Posts

- Rollups that SUCK! How have Europe's listed Underground Infra Maintenance acquirers performed?

Rollups that SUCK! How have Europe's listed Underground Infra Maintenance acquirers performed?

Pipe maintenance is a lucrative business - but you couldn't tell from the share prices of UIM roll-ups Norva24 and Wall to Wall. Here’s why. BONUS: “AI in Rollups” Summit, September 10th!

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

It is no coincidence that many of our readers are looking at built infrastructure maintenance for their next rollup idea. Verticals like fire safety, HVAC and property management are teeming with new entrants. Just yesterday, Buena joined the swelling ranks of VC-backed, AI-first German proptechs.

Much less crowded, but no less lucrative is Underground Infrastructure Maintenance, or UIM. This category includes pipe maintenance and sludge suction. We are talking real barriers to entry (lots of big specialised trucks running around), recurring revenue, double-digit operating margins, and high cash conversion.

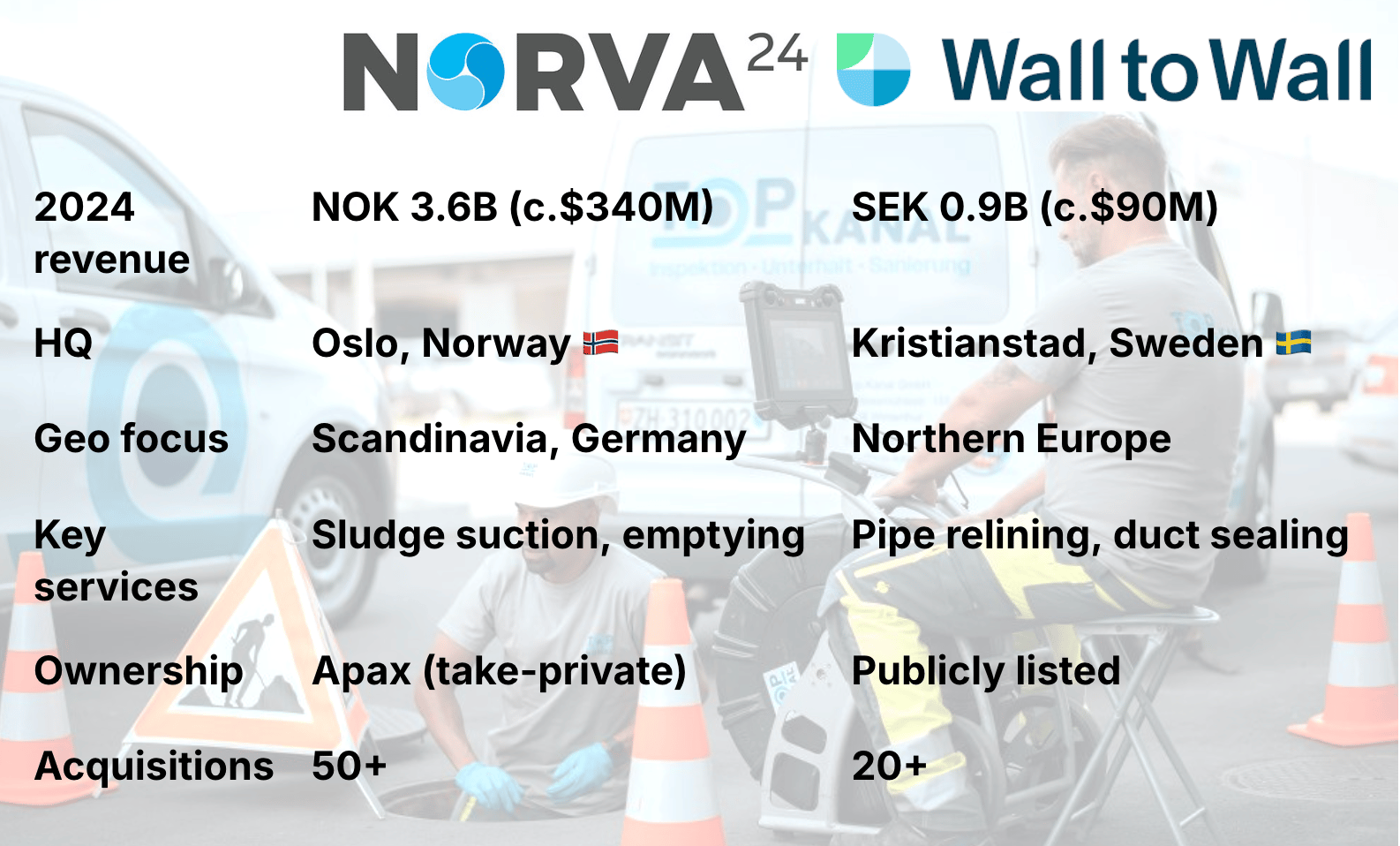

Today, we are introducing you to Norva24 and Wall to Wall Group (WTWG) - two UIM rollups. One from Norway and one from Sweden.

Source: company filings, Rollupeurope analysis

This May, the Private Equity firm Apax took Norva24 private in a $700M transaction after a mere 3.5 years as a public company. Apax won over the shareholders by merely matching the IPO price… Which nevertheless meant paying a hefty premium (+48% vs. the 30-day VWAP) after Norva’s chequered track record dented its formerly lofty valuation.

And WTWG? The share price of this Nordic pipeline “re-lining” specialist is languishing 50% below the SPAC price, giving it a market cap of $60M.

At a time of renewed focus on physical infrastructure across Europe (e.g. Germany’s €500B infra fund), valuations of companies like Norva24 and WTWG should be soaring, not tanking.

Source: Google Finance

Are their business models fundamentally flawed?

According to our research, not necessarily. The two companies offer valuable lessons around the extent of decentralisation; deal structuring - and managing investor expectations.

Read on to find out:

The investment case for UIM rollups

Norva24’s unorthodox M&A playbook

Jutzy: the German acquisition that tanked Norva’s equity story

How Wall to Wall hit the wall

Lessons learnt

Before you dig in… You guys have been asking for an AI focused Deal Summit. You got it! Join us in London on 10 September to talk all things AI in rollups. How to pitch to the VCs. What’s life like inside an AI first rollup. Get your ticket today!

Looking for investors, deal flow or talent? Apply here to pitch at the event!

1. The investment case for UIM rollups…

…goes like this:

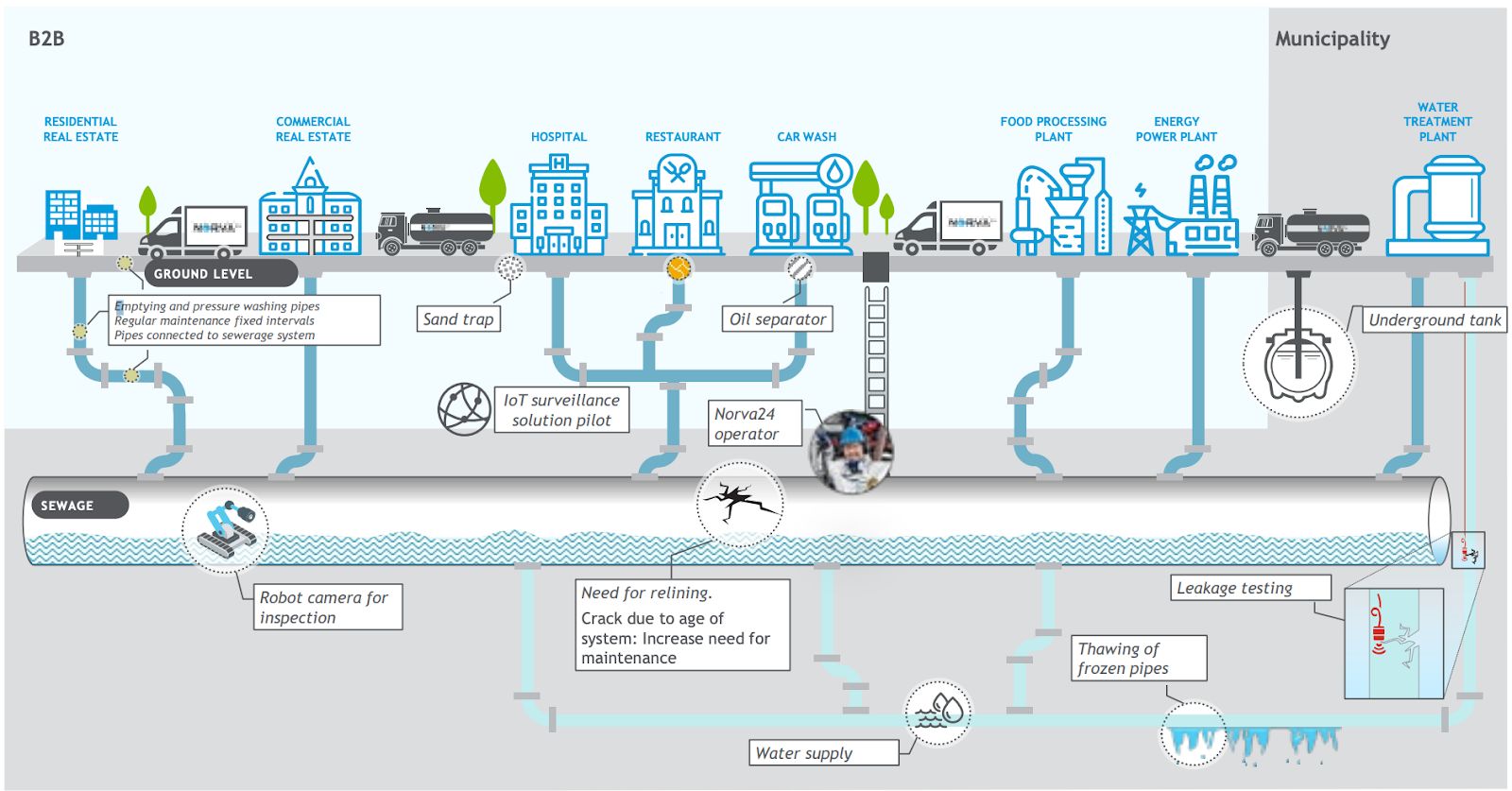

We are talking about mission critical services: think the emptying of septic tanks and pipe draining

There are barriers to entry: the services must be rendered by specialist providers that use expensive equipment like vacuum trucks

Route and network density play: the four words that get PE investors excited! Put simply, the better you are able to optimise the scheduling of visits your trucks make and efficiency of your branch network, the more operating leverage you can extract

Fragmented markets: Norva has a market share of 30% in Norway but only 10% in Sweden and Denmark (source)

As Norva’s former CEO Henrik Damgaard put it: “If you stood up in the morning and the infrastructure that Norva24 was working on was not working, you would see this as a big problem within a few minutes”.

Henrik has a point: nobody likes a backed-up toilet!

Pipe services including pipe inspections, drain and pipe cleaning, and relining are the mainstay of Norva’s business representing c.45% of revenue in 2024. The second largest category is Emptying Services (c.40% of revenue), which includes the emptying of septic tanks, grease traps, oil traps and sand traps.

Source: Norva24 filings

Norva’s customer base consists of municipalities (30% of revenue) and corporate customers (65%). The municipal sector presents a major growth opportunity due to outsourcing, driven by trends such as ageing water infrastructure; privatisation; enhanced efficiency; the pressure to reduce public sector headcount; and the skills shortage.

Private households make up the remaining 5%. In total, the company has just over 60,000 customers, of which the largest accounts for less than 3% of revenue. Customer agreements typically last 4-6 years for municipalities; corporate customers operate under framework agreements. All in all, c.75% of the revenue is recurring.

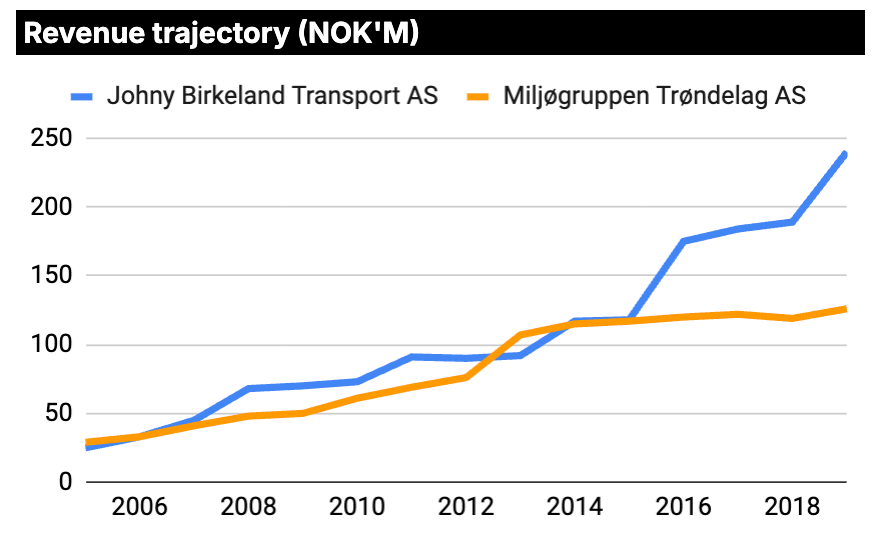

The attractiveness of Norva’s business model is best understood at a micro level: the performance of individual subsidiaries. Thankfully, the IPO prospectus breaks out revenue evolution by legal entity.

The data surprised us!

Between 2005-2019, Norva’s two largest subsidiaries at the time of the IPO - Johny Birkeland Transport and Miljøservice AS - had chalked up revenue CAGRs of 18% and 11%, respectively.

You would expect this level of compounding from an enterprise software business (think Hawk Infinity and Jotta the cloud storage provider - which we covered here) - but not from a humble UIM!

Source: Norva24 filings, Rollupeurope analysis

This data got me day dreaming. I close my eyes, and I can picture hundreds of vacuum trucks sucking gunk - and cash from the grateful, captive customers!

And, apparently, so did Norva’s IPO investors.

Valedo had tried selling the company twice, in 2020 and 2021. On both occasions the bids from Private Equity firms like Bain Capital and Apax fell short of its expectations. Second time around, this being late 2021, the alternative was a no-brainer: go public. Around the world, stockmarkets were roofing. In this exuberant environment Norva faced little pushback against an IPO valuation of 17x EBITDA and 29x EBITA (based on LTM financials).

That’s roughly 4x the multiples that Norva had been paying for acquisitions: how’s that for monster arbitrage!

Wall to Wall has a narrower different business model, operating mainly in Sweden and Finland, with 60% of revenue derived from so-called “pipe relining” services. Relining involves creating a new surface inside existing sewer pipes instead of replacing them - a cheaper alternative to trunk replacement that is a hit with the cash strapped housing associations - the largest customer category. Accordingly, the revenue profile is more project-based.

Norva and WTWG have both targeted operating (EBITA) margins of 14-15%, the level they have so far struggled to achieve. We will get as to why in a minute.

2. Norva’s unorthodox M&A playbook

In line with its Scandi compounder peers, Norva24 operated under a decentralised structure, with local branches having significant autonomy.

Since the beginning, Norva had argued that this setup enabled local management to rapidly adapt to changing market conditions and customer needs. M&A too fell within the local management’s purview, with key objectives being market share increase and route densification.

For a while, this approach seemed to pay off. In 9 years, Norva grew from 1 country to 4 and from NOK 150M in sales to NOK 3.6B. It did so by completing 50+ acquisitions. Over half of these acquisitions were add-ons. Norva typically paid 3-7x EBITA.

Wait, is there a contradiction?