- RollUpEurope

- Posts

- Buying $100M+ revenue software businesses for 1x? This can be done - if you’re Constellation Software

Buying $100M+ revenue software businesses for 1x? This can be done - if you’re Constellation Software

Forced sellers are the best sellers

Disclaimer: Unless noted otherwise, views and analysis expressed here are the author's own and based on public sources. The article is intended for informational and entertainment purposes only. This is not financial advice. Please consult a professional for investment decisions.

*********************

I know I’m stating the obvious, but Constellation Software (CSU) is an M&A beast! Whether you are running a serial acquirer, or intend to invest in one, CSU’s deal playbook should be high on your reading list.

There are so many valuable lessons in that playbook, we had to break up our take into a 4-part series. If you don't care about software, don't worry: we’ll space it out.

In Part 1, we discussed CSU’s valuation framework (the famous hurdle rates and the scenarios); deal tactics; and the compensation philosophy that fuels the relentless dealmaking.

Today, in Part 2 we will double click on the 2 transactions that showcase CSU’s ability to buy rock-solid assets (very) cheaply:

Crealogix: an opportunistic take-private in Switzerland

Optimal Blue: forced sellers are the best sellers

We conclude the article with a crisp, 60 second “Lessons Learnt” summary. Jump to it if you are time-poor - and have a premium subscription.

This autumns, stay tuned for:

Part 3: in which we will profile a small French software company that grew sales 3-fold and doubled profitability after being acquired by CSU; and

Part 4: in which we explain how CSU is managing the AI risk

Before we dive in, a word to this week’s sponsors TechMiners:

Looking for objective instead of subjective tech due diligence? TechMiners is a global consultancy specializing in tool- and data-driven technology and product due diligence for investors and technology companies.

TechMiners’ expert team of 8 CTOs (!), aided by a team of data engineers delivers clear and actionable insights to aid dealmakers. TechMiners enables confident investment and business decisions through efficient, fact-based technical assessments. No stone left unturned!

Case study #1: Crealogix - a cheap take-private in Switzerland

Crealogix is a Zurich based software company that develops and implements front end-software solutions for banks and wealth managers based predominantly in Germany and Switzerland.

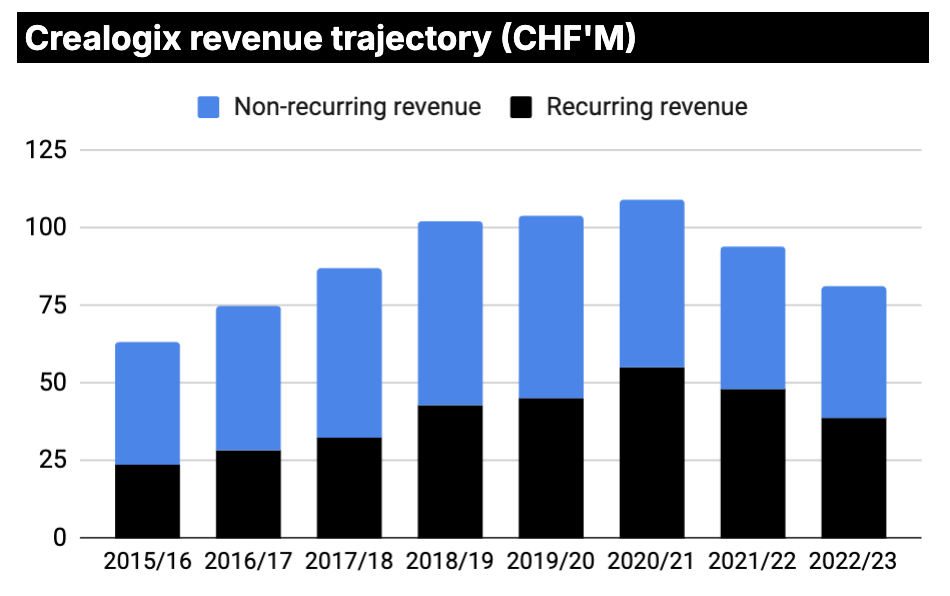

In its first two decades as a publicly listed company (2000-20) Crealogix performed well. Its sales grew fivefold: from CHF 20M to 100M+.

Crealogix headquarters in Zurich, Switzerland

Alas, after COVID the wheels came off the Crealogix equity story. Revenues dropped 14% in 2021/22 and by another 13% the following year.

Source: company filings, Rollupeurope estimates

The management pinned the blame on the strengthening Franc (fair, given that 70% of the revenues came from outside of Switzerland), divestments - and the struggle to grow recurring revenue sustainably.

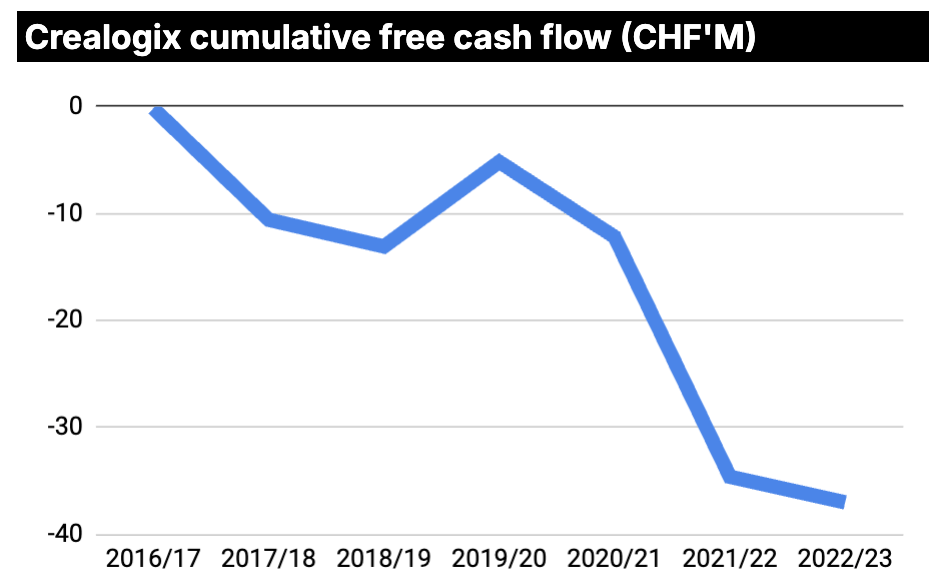

Plummeting revenue plus ballooning headcount and costs ballooned equals vanishing cash flow. In the 8 years to June 2023, Crealogix had generated cumulative free cash flow of… minus CHF 37M!

Source: company filings, Rollupeurope estimates

No wonder that, by autumn 2023, Crealogix was a down-and-out, micro-cap stock the investment community had written off. Its share price was languishing below the CHF 50 mark (CHF 70M / $80M market cap): down more than 75% from the IPO price and down 60% from the Covid-era plateau.

But was its business model fundamentally impaired? Not according to CSU. In November 2023, CSU put Crealogix’s long-suffering shareholders out of misery by submitting a takeover offer. This wasn't a lowball bid as it came with a 21% premium to the 60-day volume weighted average price (source).

Why did CSU acquire Crealogix?

From what we know, there were at least 4 reasons:

Firstly, Crealogix’s core DACH business was rock-solid, with 50% of Swiss Tier 1 banks as clients. The stock market had been obsessing over Crealogix’s failure to build a meaningful footprint outside Europe. And somehow the investors had overlooked the fact that Crealogix’s existing clients weren't going anywhere. Well, except Credit Suisse maybe!

Source: Crealogix 2021/22 annual results presentation

Secondly, CSU viewed Crealogix’s persistently low margins as an opportunity. Why were they low? The annual reports are littered with references to one-off projects such as divestments; a costly SaaS migration; and finally a monster severance programme in 2023 which cut headcount by one-quarter.

Thirdly, the management and the Board were demoralised by 2 failed sale processes (in 2018 and 2022) and a tanking share price. CSU had a prior relationship with the CEO, which helped facilitate the transaction and provide assurances with respect to shareholder acceptance of the bid.

Fourthly, and crucially, how often do you see $100M+ revenue VMS businesses change hands for 1.3x revenue / sub 3x ARR? This was a big deal by CSU’s standards, and even more so by Vencora’s - a financial services software focused vertical keen to raise its profile.

As we explained in a previous article, CSU employees are incentivised to plough excess cash flow into low-risk acquisitions that deliver instant multiple arbitrage - as opposed to organic projects that carry higher risk and longer payback periods.

Case study #2: Optimal Blue - forced sellers are the best sellers!

When we first heard about the CSU / Optimal Blue acquisition (press release), we had to rub our eyes to make sure we weren't hallucinating.

In September 2023, Perseus Software, a division of CSU, acquired two mortgage origination software providers in the US: Optimal Blue (OB) and Empower. The total purchase consideration was $905M.

For Optimal Blue specifically, CSU paid $705M, consisting of (a) $200M cash upfront; (b) a $4M holdback; and (c) a $500M Promissory Note. The Promissory Note came with unusually sweet terms:

7% coupon

40 (!) year maturity

The first cash interest + principal payment was due on the 5th anniversary of the deal. We will come back to the Promissory Note

How’s that for an LBO structure?

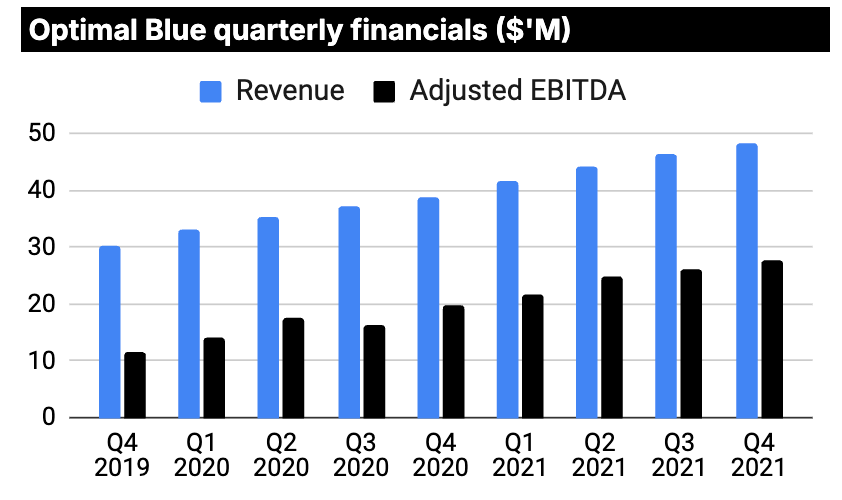

From CSU’s disclosure we estimate OB’s 2023 revenue at c.$220M, implying a revenue multiple of <3x all-in and <1x upfront. Further, factoring in OB’s 50%+ reported EBITDA margin, we arrive at EBITDA multiples of <7x all-in and <2x upfront.

To be clear: Optimal Blue isn't some small, declining VMS business. It is a category leader with $200M+ in revenue, growing by 20%+ and with a 50%+ EBITDA margin.

Source: Cannae Holdings, RollUpEurope calculations

We know what you are thinking. Is there a zero missing? Did the sellers go crazy?